Wages

The wages section uses basic data from the personnel section for its operation. It also contains lists necessary for wages calculation. These lists define, for example, the manner of calculation and composition of wages and much other information needed for a correct functioning of the wage part of the software. This section also uses attendance data from the DOCHÁZKA software, makes its own wages calculation, divides benefits among groups of employees, calculates the insurance given by the law and the yearly tax statement, prints out the required forms (wages envelopes, wage statements, funds transfer orders, overviews for the social security authority and the health insurance company, etc.).

Characteristics of specific types of employment

- manner of calculating the registration number of authorized holiday claims

- taxation manner

- manner of calculating social and health insurance for the employee or the employer in connection to duration of employment and income limits

- output settings for the social security authority

- protective period setting

- setting of maximal hours per year

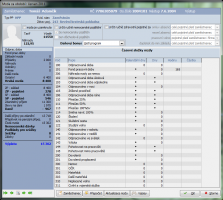

Values and characteristics of wage items

- determination of formula and its definition by compilation from a list of variables and basic calculation operations

- determination whether the given item is or is not calculated into the calculation basis for the insurance fee and the tax base

- setting of payment to monetary or non-monetary

- setting the manner for dividing the sum into incomes for the following quarters to calculate averages

Deductions characteristics

- setting whether the potential not deducted amount of a given type is registered and deducted in the following months

- setting the manner for deducting a given deduction influencing the amount of the deduction – for example whether it is possible to deduct the full amount of the wage or only a permissible minimum (according to the amount of individual subsistence wage)

- order of deduction in case there is more than one within a single wage

- setting of automatic deduction termination for gradual deductions from a set overall amount

- determination of using a formula and its definition by compilation from a list of variables and basic calculation operations

Definitions of employee groups including the structure of their wage items

- wage items applicable only for members of a group can be defined if a group of employees has been created

Definitions of shift types and their characteristics

- fixed or flexible working hours (with determination of a fixed core hours)

- premium type setting option

- possibility to define a second shift within one day

- working hours fund by calendar definition; this is connected to the possibility to adjust the number of workdays, paid holidays, working hours scheduling and shifts setting

- option of regular working hours or irregular working hours with possible specific shifts schedule.

Contact

RON Software, spol. s r.o., Rudé armády 2001, 733 01 Karviná-Hranice / tel.: +420 595 538 200 / e-mail: software@ron.cz / GPS: N 49.871959, E 18.54887

- Home (EN) /

- Company Profile /

- Contact /

- Products /

- Services /

- References /

- Product catalogs /

- Sitemap